Thanks for joining uspublished at 20:30 GMT 10 December

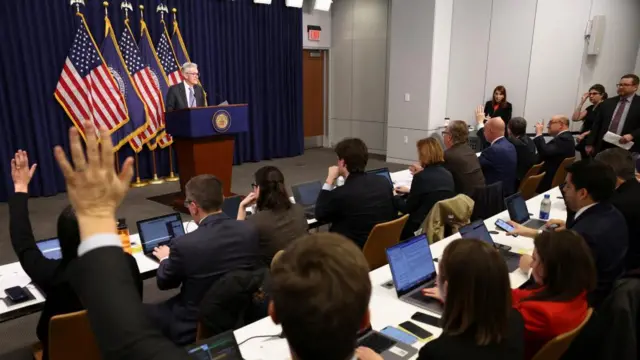

Powell has wrapped up his remarks. Here's what we've learned today:

- The US central bank cut interest rates by a quarter percentage point, as expected. That lowered the target for its key lending rate to a range of 3.5% to 3.75%, the lowest since 2022.

- Fed members remain very divided about what to do next and even about today's move, with three formal dissents and several others signalling reservations on the decision to cut in their projections of appropriate policy.

- The next move is unlikely to be immediate. Powell said repeatedly he thought the bank was now "well positioned to wait" to see what happens to jobs and inflation.

- While official forecasts for growth and inflation have improved, Powell said both areas face risks, warning in particular that jobs data could be overestimating hiring. Conversely, he said he was optimistic that tariff-related inflation would not spread to the wider economy.

- On the ground, today's cut should bring some relief to borrowers. But Powell conceded that the impact may not be large - especially in the housing market, where tight supply remains a significant issue.

That's all for now. Thanks for joining us.